How We Help You Meet Your Financial Goals

How We Help You Meet Your Financial Goals

Everything Starts with a Plan:

Everything Starts with a Plan:

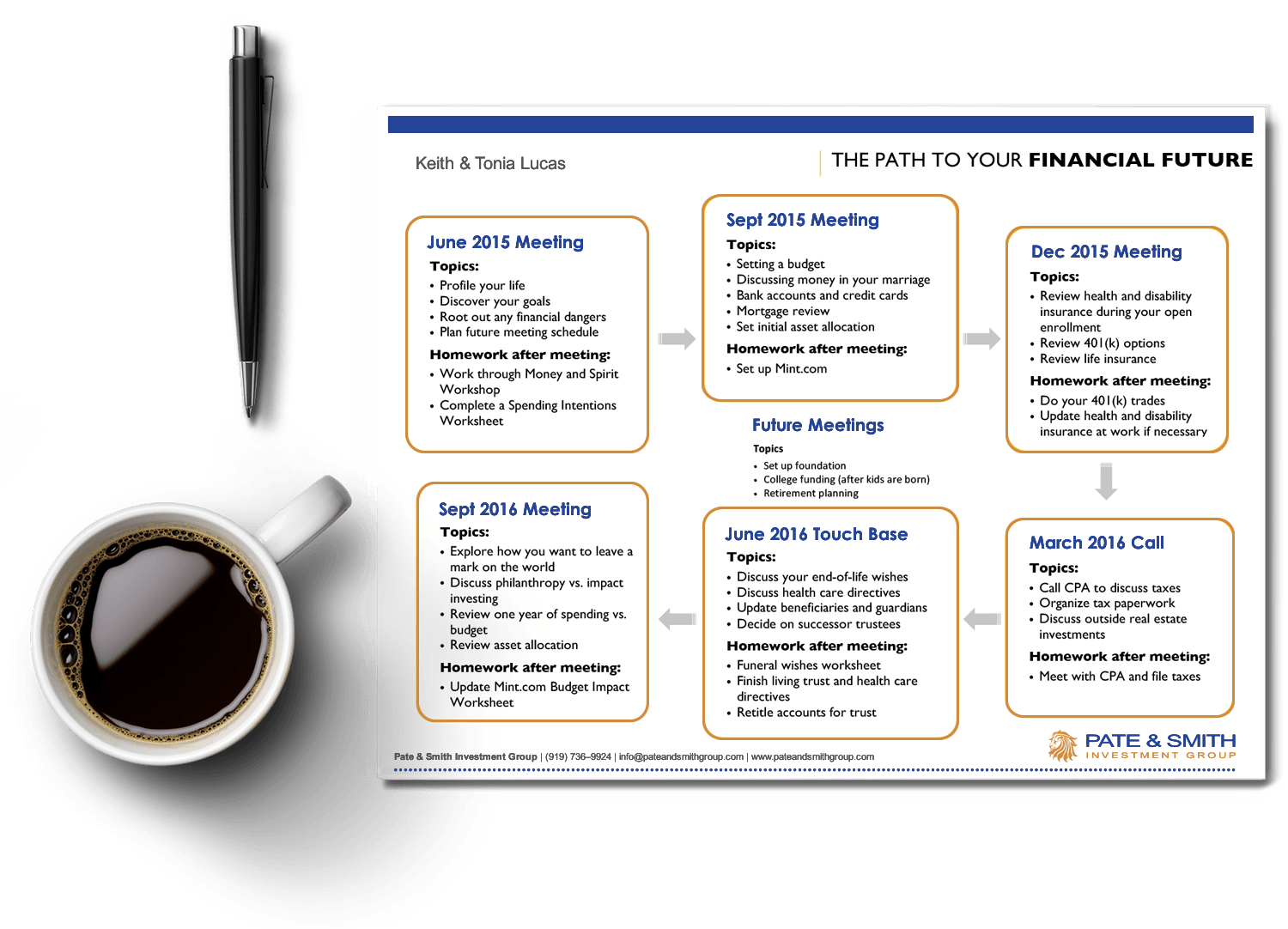

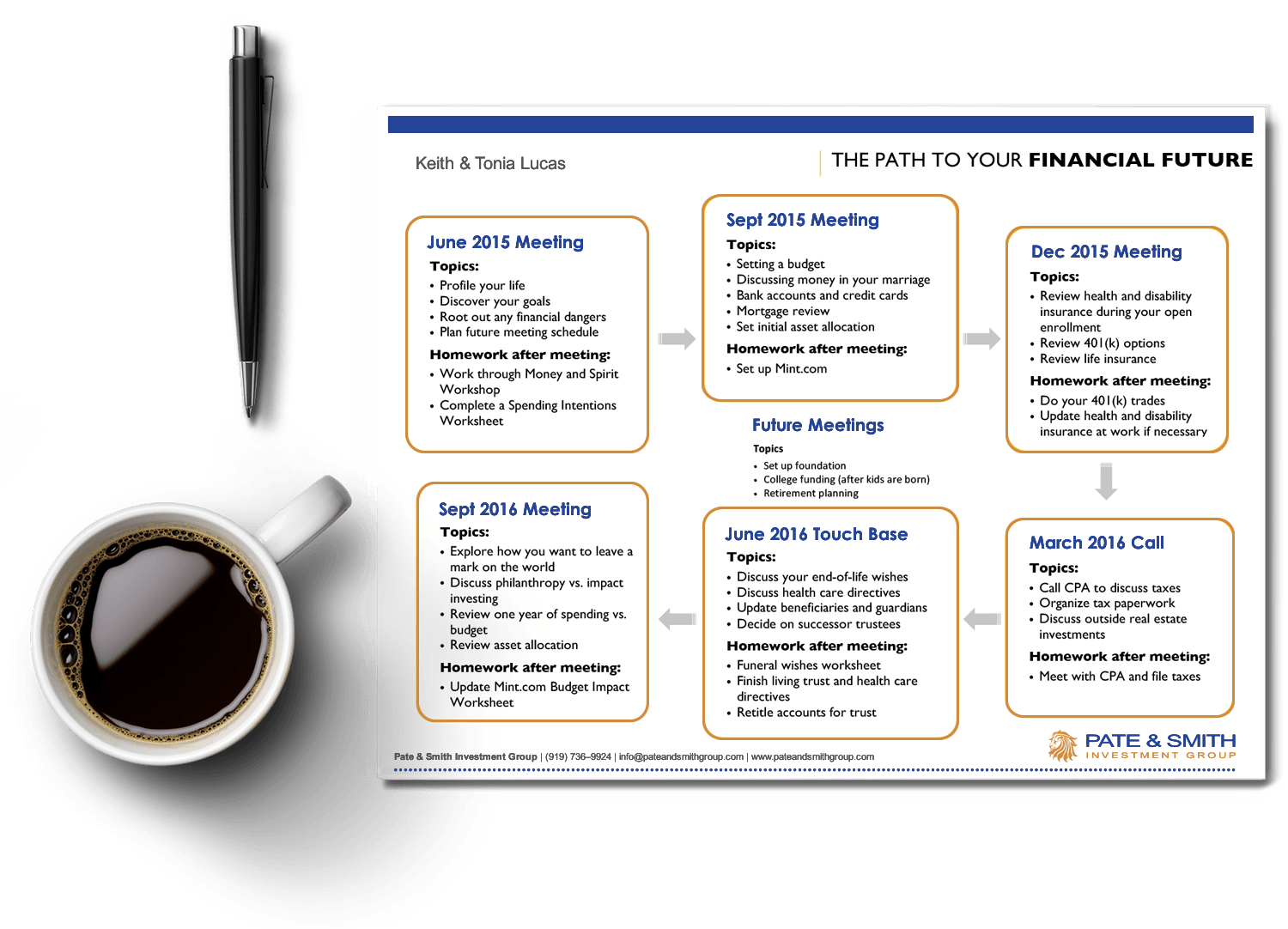

Once we understand your goals and values (always the first step), we develop your personalized roadmap. We always strive to take manageable steps to improve your financial life. If we go too fast, you may burn out and stop improving. If we go too slowly, you may miss important opportunities to save money, protect yourself from life’s biggest risks or achieve your goals. We’ll help you make sure that the most critical tasks are prioritized quickly and the less important tasks are scheduled in the future rather than forgotten altogether.

We then meet two to four times a year by phone, by video or in person (frequency and location are up to you) to ensure that all the critical actions are being taken, whether by you or by us. Your financial adviser will be a great listener, a wealth of actionable advice, your database of financial knowledge and sometimes your biggest cheerleader.

We have no investment asset minimums to become a client. Our financial planning services are available to small personal investments up-to larger investments by business. Please fill out the short form below to have an adviser contact you to see how we might help.

Once we understand your goals and values (always the first step), we develop your personalized roadmap. We always strive to take manageable steps to improve your financial life. If we go too fast, you may burn out and stop improving. If we go too slowly, you may miss important opportunities to save money, protect yourself from life’s biggest risks or achieve your goals. We’ll help you make sure that the most critical tasks are prioritized quickly and the less important tasks are scheduled in the future rather than forgotten altogether.

We then meet two to four times a year by phone, by video or in person (frequency and location are up to you) to ensure that all the critical actions are being taken, whether by you or by us. Your financial adviser will be a great listener, a wealth of actionable advice, your database of financial knowledge and sometimes your biggest cheerleader.

We have no investment asset minimums to become a client. Our financial planning services are available to small personal investments up-to larger investments by business. Please fill out the short form below to have an adviser contact you to see how we might help.